Examining China’s Global Port Empire

Recent data confirms that Chinese state ownership of ports, or investment firms that own ports, carries a unique array of economic, strategic, and political risks for recipient port states.

Beijing is now the world’s largest holder of international port assets. Through a network of dozens of state-owned port operators, contractors, investment firms, and banks, the Chinese state has invested upwards of $110 billion in foreign port operation and development projects across eighty port states, a value equivalent to the total outward foreign direct investment (ODFI) stock of Israel.

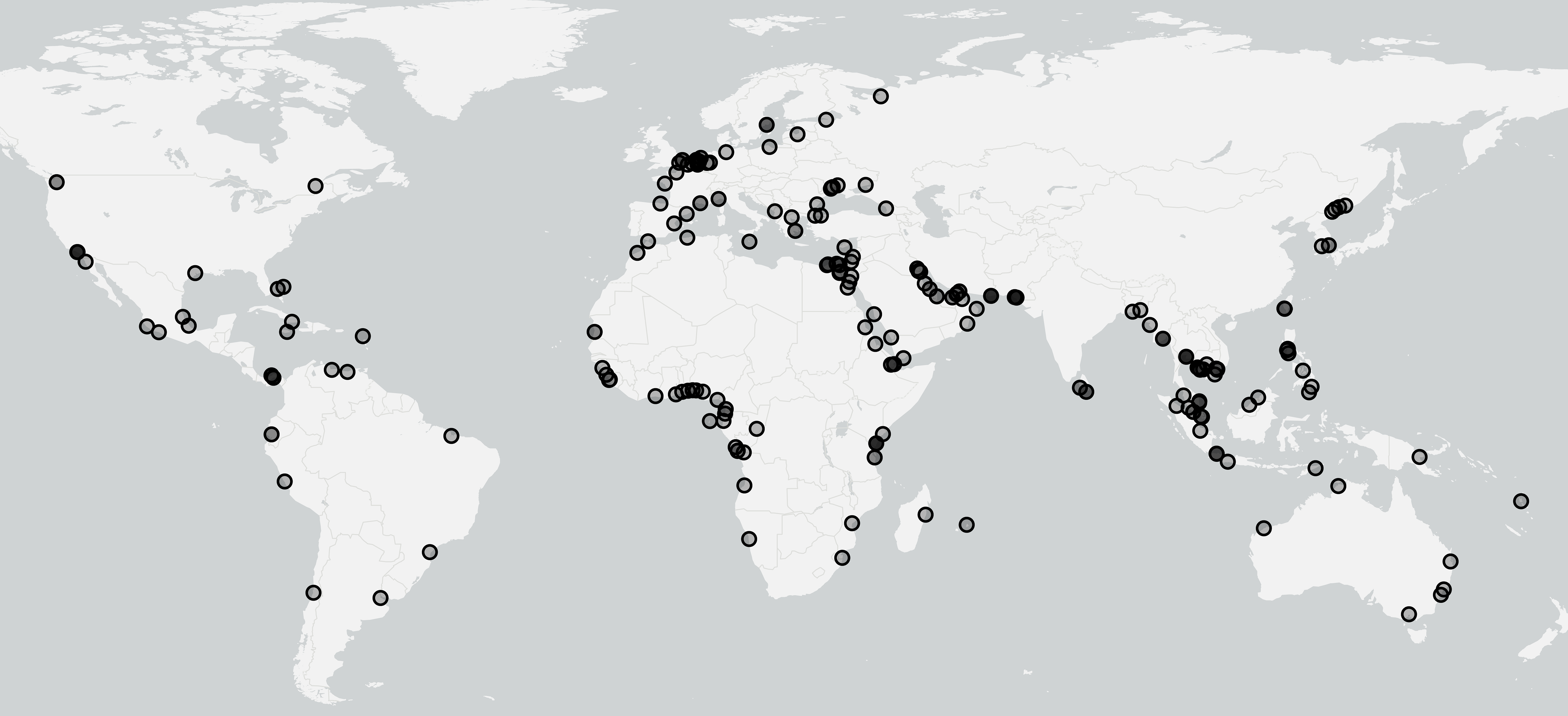

Figure 1. Locations of port investments by Chinese state-owned enterprises.

Figure 2. Chinese state-owned enterprises investing in foreign ports.

These investments were mostly made in the wake of the 2008 Global Financial Crisis, when demand for capital was high and the rehabilitative and mutually beneficial effects of foreign direct investment (FDI) were presumed.

However, the emergence of several troubled Chinese state-led port investments has diminished this optimism. Contentious contract renegotiations, threatened project cancellations, or outright bans on Chinese FDI signal growing unease about “handing over the keys” of one’s critical infrastructure to a foreign government. Such concerns are not unfounded. In a recently published article in the journal Marine Policy (available open access) my co-authors and I argue that the political nature of these investments vis-à-vis Chinese state ownership of the investing firms carries a unique array of economic, strategic, and political risks for the recipient port states.

First, Chinese state-led investments are uniquely susceptible to commercial failure. Overcapacity is a systemic problem in China’s industrial economy, driven by national subsidies and poor internal controls on state-led industrial development. Since 2013, Beijing’s policy on correcting overcapacity has been to offshore it to developing economies through large-scale overseas infrastructure development projects. The result has been several “white elephant”-type port development projects, driven by China’s need to relieve pressure on bloated domestic industries rather than projected commercial benefits for the recipient port state. The most well-known of these is Hambantota Port, whose annual losses of $60 million meant that Sri Lankan authorities were only able to repay the $1.5 billion in Chinese loans used to finance its development by awarding a ninety-nine-year lease to a Chinese state-owned port operator.

Second, Chinese state-led investments risk the host state becoming entrapped in China’s military disputes. As Chinese state control over foreign port assets has grown, Chinese military strategists have increasingly been positioning these assets within Beijing’s naval doctrine. Specifically, these strategists argue that foreign port assets, despite being procured under commercial pretenses, may be appropriated for military missions, ranging from general reconnaissance to serving as logistics and replenishment hubs for Chinese naval vessels. If such military uses were attempted, the host port state would be in the invidious position of either accepting Chinese military operations in its territorial waters and risking retaliation from China’s military rivals, or rejecting Chinese military operations in its territorial waters and risking retaliation from China.

Third, port states hosting Chinese state-led investments risk becoming targets for espionage. Ports are rich targets in this case, both in military and commercial terms. Militarily, espionage can reveal the movement of military hardware through the port as well as the operational characteristics of foreign or domestic navies using the port; for example, resupply and materiel requirements, personnel identities, and origins and onward destinations. Commercially, espionage can provide commercial intelligence on traded consignments and port services which can be mined to provide a competitive advantage to competing firms or identify chokepoints in the industrial strategies of port states. Chinese state actors may, working through Chinese state-owned firms controlling foreign port assets, embed surveillance equipment and personnel into those assets to pursue these military and commercial dividends.

And fourth, Chinese state-led port investments may become vehicles for economic coercion. In times of political conflict between Beijing and the port state, Beijing may instruct its state-owned port investors operating in that state to disrupt port operations, such as by diverting port traffic, halting terminal operations, withholding follow-on funding, initiating vexatious litigation, or terminating the contract. This creates pressure on port states to avoid political conflicts with Beijing to maintain the economic well-being of its Chinese-controlled ports, potentially limiting the port state’s autonomy when dealing with issues sensitive to Beijing. For example, observers have credited Greece’s 2017 veto of a European Union statement on human rights in China on China’s state-owned port operator COSCO taking a controlling stake in Greece’s busiest port the year prior.

While China’s port investments should be encouraged to the extent that they help close the international infrastructure gap, increase legitimate competition among international shipping and logistics providers, and further integrate China into the global economy, port states must remain attentive to the multifaceted risks posed by China’s unique state-led OFDI program.

Dr. Christopher J. Watterson is a Research Fellow at the Department of War Studies, King’s College London.

Image: Shutterstock.